BitCoin Market Cap

Cryptocurrencies: A Digital Goldrush?

Part I: Market Capitalization

Market capitalization is realized through a simple formula:

Market Price of a Single Share X Number of Shares Outstanding

Digital currencies are all the rage, and may currently be imploding. We’ll have to wait and find out what happens in due time.

While we wait, we can at least gawk at the obscene amount of value they have generated in their infancy.

We’re going to survey the field of cryptocurrencies currently on market, and calculate the wealth contained within via a market capitalization analysis. To accomplish this, we’re going to utilize Python and Pandas to generate our data, and visualize it with MatPlotLib using a Jupyter Notebook.

Getting Started - Loading Data

So, let’s grab some data from the available API and see what we have. First, notice we’ve imported Pandas as pd, matplotlib.pyplot as plt, and set our style to fivethirtyeight, I’d also suggest setting it to ggplot for another snazzy(and professional) theme.

# Importing pandas

import pandas as pd

# Importing matplotlib and setting aesthetics for plotting later.

import matplotlib.pyplot as plt

%matplotlib inline

%config InlineBackend.figure_format = 'svg'

plt.style.use('fivethirtyeight')

# Reading in current data from coinmarketcap.com

current = pd.read_json("https://api.coinmarketcap.com/v1/ticker/")

Exploratory Data Analysis - EDA

As always, let’s start by taking a peek at what we have.

# Print Column Names

print(current.columns)

# Check Head

print(current.head())

# Check Tail

print(current.tail())

Our output looks like this…

Index(['24h_volume_usd', 'available_supply', 'id', 'last_updated',

'market_cap_usd', 'max_supply', 'name', 'percent_change_1h',

'percent_change_24h', 'percent_change_7d', 'price_btc', 'price_usd',

'rank', 'symbol', 'total_supply'],

dtype='object')

24h_volume_usd available_supply id last_updated \

0 9898900000 16819812 bitcoin 1516660460

1 3594420000 97146771 ethereum 1516660452

2 2119670000 38739142811 ripple 1516660442

3 642242000 16926100 bitcoin-cash 1516660457

4 475086000 25927070538 cardano 1516660460

market_cap_usd max_supply name percent_change_1h \

0 177126076210 2.100000e+07 Bitcoin 2.06

1 94059737996 NaN Ethereum 3.04

2 46788749296 1.000000e+11 Ripple 2.53

3 26496116940 2.100000e+07 Bitcoin Cash 1.88

4 14143424395 4.500000e+10 Cardano 3.25

percent_change_24h percent_change_7d price_btc price_usd rank \

0 -7.93 -24.03 1.000000 10530.800000 1

1 -6.59 -25.29 0.092869 968.223000 2

2 -12.06 -29.91 0.000116 1.207790 3

3 -10.83 -34.82 0.150147 1565.400000 4

4 -10.06 -31.01 0.000052 0.545508 5

symbol total_supply

0 BTC 16819812

1 ETH 97146771

2 XRP 99993093880

3 BCH 16926100

4 ADA 31112483745

24h_volume_usd available_supply id last_updated \

95 15913400 617314171 quantstamp 1516660463

96 3304050 10891318 bitcore 1516660454

97 11584700 104661310 tenx 1516660455

98 142157 1000000000 xplay 1516660458

99 16741300 342699966 civic 1516660457

market_cap_usd max_supply name percent_change_1h \

95 252963618 NaN Quantstamp 5.32

96 251393411 21000000.0 Bitcore 5.56

97 230343844 NaN TenX 3.48

98 228942000 NaN XPlay 3.01

99 220564097 NaN Civic 2.04

percent_change_24h percent_change_7d price_btc price_usd rank symbol \

95 -7.65 -4.53 0.000039 0.409781 96 QSP

96 -13.68 -21.03 0.002214 23.082000 97 BTX

97 -7.61 -35.45 0.000211 2.200850 98 PAY

98 -8.60 -20.43 0.000022 0.228942 99 XPA

99 -9.57 -34.37 0.000062 0.643607 100 CVC

total_supply

95 976442388

96 16763281

97 205218256

98 10000000000

99 1000000000

Let’s make note of our columns, immediately we should realize we don’t even need our simple market capitalization formula, as it’s already been calculated for us as ‘market_cap_usd’.

Let’s make a quick list of useful columns:

- id

- market_cap_usd

- percent_change_24h

- percent_change_7d

Now, we’ve only peeked at a limited set of the JSON data, so let’s look at a more comprehensive list from a stored csv that’s been translated from the JSON source.

# Read the CSV

csv_data = pd.read_csv('datasets/coinsJan2018.csv')

raw_df = pd.DataFrame(csv_data)

# Extract 'id' and 'market_cap_usd'

market_cap_raw = raw_df[['id','market_cap_usd']]

# Using .info()

print(market_cap_raw.info())

# Summary Statistics

print(market_cap_raw.describe())

# Counting the number of values

market_cap_raw.count()

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 1474 entries, 0 to 1473

Data columns (total 2 columns):

id 1474 non-null object

market_cap_usd 1123 non-null float64

dtypes: float64(1), object(1)

memory usage: 17.3+ KB

None

market_cap_usd

count 1.123000e+03

mean 4.737687e+08

std 6.510767e+09

min 1.200000e+01

25% 7.937405e+05

50% 6.616421e+06

75% 4.118481e+07

max 1.840834e+11

id 1474

market_cap_usd 1123

dtype: int64

Notice that the id and market_cap_usd values are different? We have missing data. We need to handle that.

There are multiple ways to handle the missing data, often we will choose to simply utilize .dropna(), but in this case let’s use .query().

# Filtering out rows without a market capitalization

market_cap_filtered = market_cap_raw.query('market_cap_usd > 0')

# Counting the number of values again

print(market_cap_filtered.info())

print(market_cap_filtered.count())

<class 'pandas.core.frame.DataFrame'>

Int64Index: 1123 entries, 0 to 1122

Data columns (total 2 columns):

id 1123 non-null object

market_cap_usd 1123 non-null float64

dtypes: float64(1), object(1)

memory usage: 21.9+ KB

None

id 1123

market_cap_usd 1123

dtype: int64

Great! We’ve removed the missing/non-capitalized coins from our dataset.

Now we can proceed.

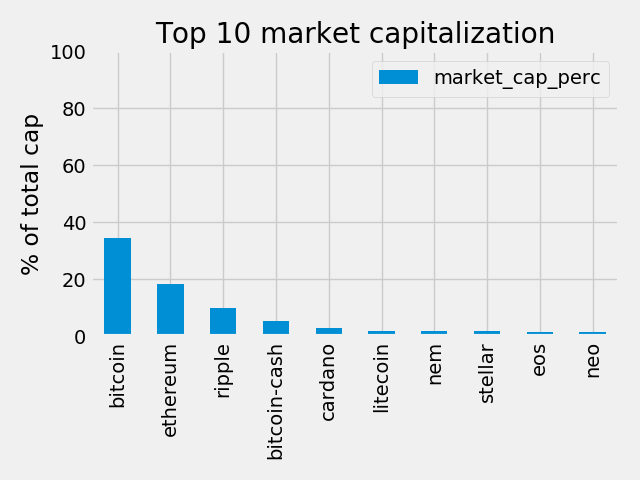

Let’s get a sense of the distributions of value within the crypto field. We’re going to plot the top 10 currencies ranked by market capitalization and displayed as a bar plot. Bar plots are great in this situation because they communicate a density of information with easy audience intuition, and fit our situation as we are binning categorical data by ‘id’.

First, let’s make some decisions about what we’re doing to help frame our process. Let’s set our title, and the y-axis labels

as ‘Top 10 Currencies by Market Cap’, and ‘Percent Total (%)’

TOP_TEN_TITLE = ''Top 10 Currencies by Market Cap''

TOP_TEN_YLABEL = 'Percent Total (%)'

We can neglect naming the X-axis because we’re going to be displaying the names of each coin, so we don’t need to communicate this label to our audience for them to understand the plot and properly interpret the data, otherwise you should really give more consideration about your axes designations. Your goal is not only to communicate data, but also give your audience the variables they need to understand what they’re looking at, to craft their own analysis, and ask intelligent questions.

Let’s use slicing to return the top ten results already sorted for us, so we don’t need to utilize a sorting method now (spoiler: We will later) to yield our list.

So, we will slice indices [0:10] from our filtered list and set our index to id

top_10 = pd.DataFrame(market_cap_filtered[0:10]).set_index('id')

Now let’s do some math with our dataframe, and create a new column using .assign and named market_cap_percent, with index values representing the percentage of each coin’s market cap. The math is simply each coin’s value divided by the total market’s multiplied by 100, which we will model as:

# market_cap_perc

top_10 = top_10.assign(market_cap_perc=(top_10.market_cap_usd / market_cap_filtered.market_cap_usd.sum()) * 100)

Now we can create our plot of just the percentages representing the top-10 currencies as follows:

# Plot- Figure 1

ax = top_10.plot.bar(y='market_cap_perc', title=TOP_CAP_TITLE)

ax.set_ylabel(TOP_CAP_YLABEL)

plt.show()

So, it looks like Bitcoin is around 35% of the total market. This is actually lower than I expected, so I’m glad I plotted this one out. I guesss the 1000+ other coins have accrued some value with the rise of BitCoin.

It’s a boring graph though.

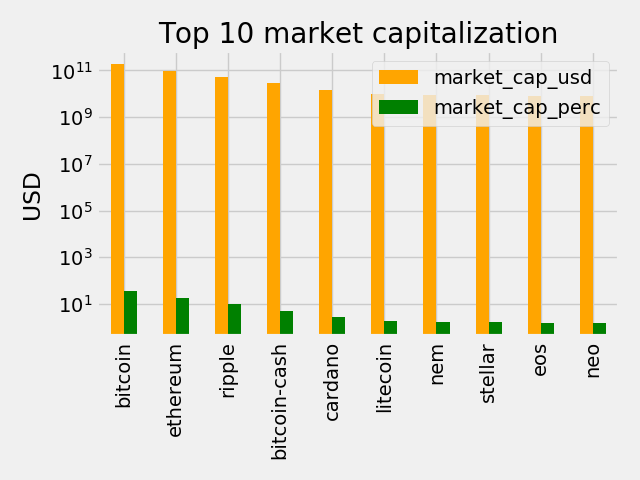

Let’s throw in a second column per bin, representing the value in USD, and set a log scale on the y-axis to deal with the large numbers($180 billion in BitCoin’s case).

#Plot- Figure 2

# Colors for the bar plot

COLORS = ['orange', 'green']

# adding the colors and scaling the y-axis

ax = top_10.plot.bar(title = TOP_CAP_TITLE, color = COLORS)

ax.set_yscale('log')

# Annotating the y axis with 'USD'

ax.set_ylabel('USD')

# Removing useless x-label

ax.set_xlabel('')

plt.show()

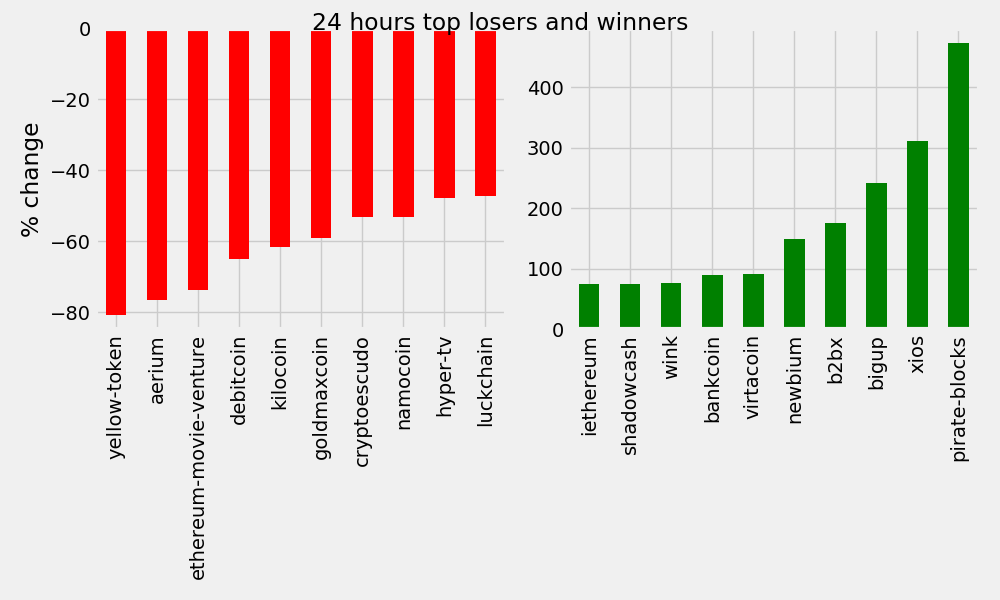

Part II: Measuring volatility

Now, things have been turbulent recently. Let’s get a sense of the movers and shakers. We’ll assay the movement via percent change of market value, from a 24 hour interval, and over a week’s time.

Nothing too fancy here, let’s again extract our target columns percent_change_24h and percent_change_7d.

The spoiler from earlier is appropriate now, we’re going to sort our dataframe by id and with ascending = True to separate our winners/losers by conveniently utilizing .head() and .tail()

# Selecting the id, percent_change_24h and percent_change_7d columns

volatility = raw_df[['id', 'percent_change_24h', 'percent_change_7d']]

# Setting the index to 'id' and dropping all NaN rows

volatility = volatility.dropna().set_index('id')

# Sorting the DataFrame by percentage_change_24h in ascending order

volatility = volatility.sort_values(by = 'percent_change_24h', ascending = True)

# Checking the first few rows

print(volatility.head())

print(volatility.tail())

Let’s check the output…

percent_change_24h percent_change_7d

id

yellow-token -80.77 -52.88

aerium -76.69 -51.57

ethereum-movie-venture -73.67 -10.73

debitcoin -65.10 -60.04

kilocoin -61.52 -81.44

percent_change_24h percent_change_7d

id

newbium 149.02 234.05

b2bx 176.00 97.82

bigup 241.04 -10.49

xios 311.48 275.85

pirate-blocks 473.79 214.81

It looks like volatility is alive in well during this correction/implosion/bursting bubble/discount opportunity. But we’re visual creatures, let’s take a look and plot our data again…

# Defining a function with 2 parameters, the series to plot and the title

def top10_subplot(volatility_series, title):

# Making the subplot and the figure for two side by side plots

fig, axes = plt.subplots(nrows=1, ncols=2, figsize=(10, 6))

# Plotting with pandas the barchart for the top 10 losers

ax1 = volatility_series[:10].plot.bar(color="red", ax=axes[0])

# Setting the figure's main title to the text passed as parameter

fig.suptitle(title)

# Setting the ylabel to '% change'

ax1.set_ylabel('% change')

ax1.set_xlabel('')

# Same as above, but for the top 10 winners

ax2 = volatility_series[-10:].plot.bar(color="green", ax=axes[1])

ax2.set_xlabel('')

plt.tight_layout()

plt.show()

# Returning this for good practice, might use later

return fig, axes

DTITLE = "24 hours top losers and winners"

# Calling the function above with the 24 hours period series and title DTITLE

fig, ax = top10_subplot(volatility['percent_change_24h'], DTITLE)

# Sorting in ascending order

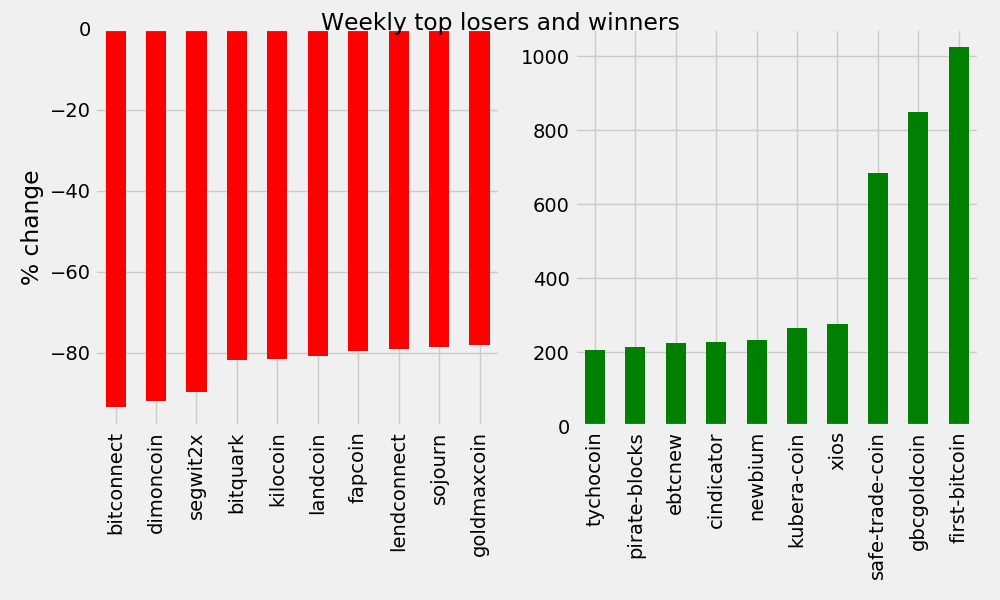

volatility7d = volatility['percent_change_7d'].sort_values(ascending = True)

WTITLE = "Weekly top losers and winners"

# Calling the top10_subplot function

fig, ax = top10_subplot(volatility7d, WTITLE)

24 Hour Winners/Losers

7-Day Winners/Losers

These are massive swings in either direction. However, it’s important to note that those affected are largely very low value cryptocurrencies.

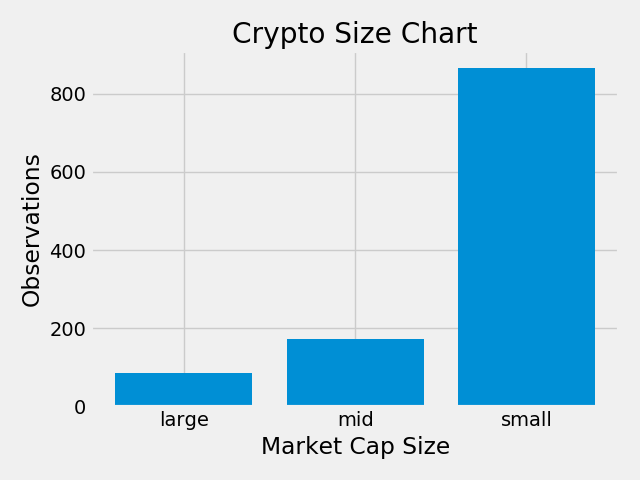

We should classify the coins based on their relative values. We’ll do this by filtering our dataframe into subsets we can categorize. We’ll define large, medium, and small cap value groups.

# Function to return cap counts, pass in an argument 'market_cap_usd larger or smaller than value'

def capcount(query_string):

#return a query for the designated size condition, returns a count of that query

return cap.query(query_string).count().id

# Labels for the plot

LABELS = ["large", "mid", "small"]

# Using capcount count the 'large' coins

medium = capcount('market_cap_usd > 300000000')

# get the micro counts

micro = capcount('market_cap_usd < 300000000 and market_cap_usd > 50000000')

# and the nano counts

nano = capcount('market_cap_usd < 50000000')

# Populate a list with the 3 counts

values = [large, micro, nano]

# Plot them out with matplotlib

plt.bar(range(len(values)), values, tick_label = LABELS)

plt.title("Crypto Size Chart")

plt.ylabel("Observations")

plt.xlabel("Market Cap Size")

plt.tight_layout()

plt.show()

Classification counts of cryptocurrencies